P = [3.5000 1.1100 1.1100 1.0400 1.0100;

0.5000 0.9700 0.9800 1.0500 1.0100;

0.5000 0.9900 0.9900 0.9900 1.0100;

0.5000 1.0500 1.0600 0.9900 1.0100;

0.5000 1.1600 0.9900 1.0700 1.0100;

0.5000 0.9900 0.9900 1.0600 1.0100;

0.5000 0.9200 1.0800 0.9900 1.0100;

0.5000 1.1300 1.1000 0.9900 1.0100;

0.5000 0.9300 0.9500 1.0400 1.0100;

3.5000 0.9900 0.9700 0.9800 1.0100];

[m,n] = size(P);

Pi = ones(m,1)/m;

x_unif = ones(n,1)/n;

cvx_begin

variable x_opt(n)

maximize sum(Pi.*log(P*x_opt))

sum(x_opt) == 1

x_opt >= 0

cvx_end

R_opt = sum(Pi.*log(P*x_opt));

R_unif = sum(Pi.*log(P*x_unif));

display('The long term growth rate of the log-optimal strategy is: ');

disp(R_opt);

display('The long term growth rate of the uniform strategy is: ');

disp(R_unif);

rand('state',10);

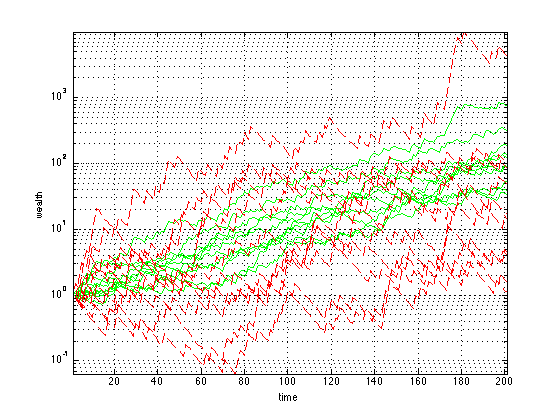

N = 10;

T = 200;

w_opt = []; w_unif = [];

for i = 1:N

events = ceil(rand(1,T)*m);

P_event = P(events,:);

w_opt = [w_opt [1; cumprod(P_event*x_opt)]];

w_unif = [w_unif [1; cumprod(P_event*x_unif)]];

end

figure

semilogy(w_opt,'g')

hold on

semilogy(w_unif,'r--')

grid

axis tight

xlabel('time')

ylabel('wealth')

Successive approximation method to be employed.

SDPT3 will be called several times to refine the solution.

Original size: 35 variables, 21 equality constraints

10 exponentials add 80 variables, 50 equality constraints

-----------------------------------------------------------------

Cones | Errors |

Mov/Act | Centering Exp cone Poly cone | Status

--------+---------------------------------+---------

10/ 10 | 2.272e-01 3.277e-03 0.000e+00 | Solved

10/ 10 | 2.176e-02 3.026e-05 0.000e+00 | Solved

8/ 10 | 2.785e-03 4.952e-07 0.000e+00 | Solved

0/ 8 | 3.602e-04 8.044e-09 0.000e+00 | Solved

-----------------------------------------------------------------

Status: Solved

Optimal value (cvx_optval): +0.0230783

The long term growth rate of the log-optimal strategy is:

0.0231

The long term growth rate of the uniform strategy is:

0.0114